Competitiveness

Work with European regulators to maintain and heighten EU shipping’s global competitiveness in order to safeguard Europe’s position as a major

shipping region

As other global shipping centres around the world gain ground with intensive support from their governments, preserving and improving the existing policy framework is essential to keep the EU shipping industry competitive.

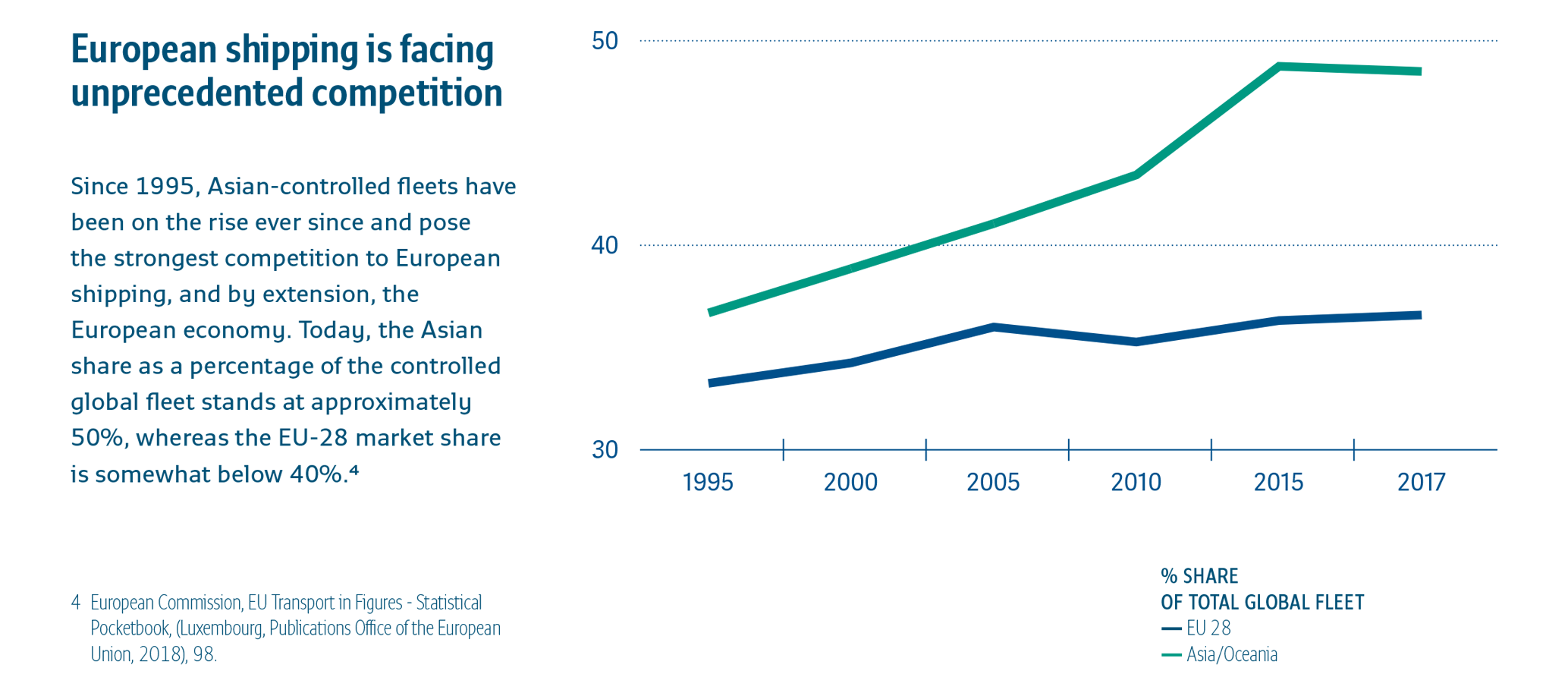

The EU shipping sector benefits from a policy framework which is overall strong and consistent. The EU’s Guidelines on State Aid to Maritime Transport (SAGs) have been a precondition for the competitiveness of the European shipping industry, allowing our companies to grow their controlled fleet to 40% of the overall world tonnage. To this end, the Guidelines must remain flexible and fit for purpose.

However, as other global shipping centres around the world gain ground with intensive support from their governments, preserving and improving the existing policy framework is essential to keep the EU shipping industry competitive. Monitoring and taking inspiration from developments globally in terms of the framework applicable to shipping is crucial to ensure the EU is on pair with other shipping centres around the world.

The backbone of the EU maritime cluster are the shipping companies: the presence and development of European maritime industries and, by extension, of employment opportunities and retention of skills and expertise, is conditional upon the existence of a globally competitive EU shipping.

A strong shipping community is not only indispensable for the European maritime cluster, but for the European Union as a whole, as EU shipping is a solid contributor to the European agenda of jobs and growth and one of the very few strategic assets to the EU.

To help advance its competitive edge, EU shipping needs stable access to competitive financing in Europe. For the EU there is a lot at stake. The EU has strong interests: adequate financing helps to maintain shipping companies’ presence in Europe, which in turn ensures the added value to remain in Europe. Having a strong ship financing community in Europe also benefits the European maritime cluster and the European economy at large. With stricter capital requirements for banks and many European banks leaving ship finance, it is high time to make ship financing a priority. In this context, it is timely to look at what financing tools are best suited to the sector. Depending on the size of company, the nature of the sector, and the investments needed, shipping companies need to have access to traditional banking tools, covered bonds, or other alternatives. The access to financing is key for the maritime cluster to be competitive globally, especially for smaller and medium-sized shipping companies challenges are considerable.

ECSA would like to work with the regulators to:

- formulate a comprehensive and globally oriented shipping and maritime policy in the EU, with a strong focus on supporting the global competitiveness of the shipping and wider maritime sector, which cuts across policy fields like transport, taxation, environment, social and others

- avoid deviating from or going beyond IMO/ILO conventions in EU and member state regulation

- maintain the effectiveness of the existing SAGs, improve legal clarity around their application and ensure an efficient and swift EU approval process for national state aid measures

- support the creation of attractive EU ship-financing schemes, that cater for nature of the sector including SMEs. New instruments such as Horizon Europe and the forthcoming Connecting Europe Facility (CEF) II must support the shipping sector in its Research & Innovation and deployment efforts

- strengthen ship-financing expertise and capacity in Europe

- ensure EU shipowners can continue to secure adequate and attractive financing from banks in Europe, as well as from other sources

- develop a benchmarking exercise to map out what third countries are offering in terms of competitiveness and other growth initiatives, to ensure the EU is not losing out